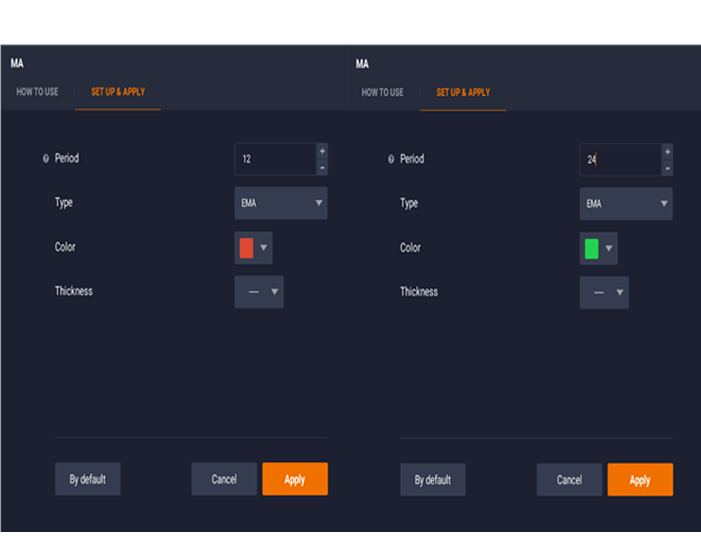

The 5 8 13 21 EMA strategy is a trading technique that uses Exponential Moving Averages (EMAs) of four different periods – 5, 8, 13, and 21 days – to determine entry and exit points in the market. Traders use this strategy to identify potential trends and momentum in the price of a security. Here’s a breakdown of how the strategy works:

-

5-Day EMA: This is the fastest moving among the four and reacts quickly to price changes. It helps in identifying short-term price momentum.

-

8-Day EMA: A bit slower than the 5-day EMA, the 8-day EMA adds more stability and is still used to gauge short-term trends.

-

13-Day EMA: This EMA tracks the medium-term trend and is less reactive to daily price fluctuations compared to the 5 and 8-day EMAs.

-

21-Day EMA: The slowest of the four, the 21-day EMA is used to represent the longer-term trend.

In practice, traders might look for situations where the shorter-term EMAs cross above the longer-term EMAs as a signal for bullish momentum, suggesting a potential buying opportunity. Conversely, when shorter-term EMAs cross below the longer-term EMAs, it may signify bearish momentum, indicating a selling or shorting opportunity.

Traders might also look at the slope of these EMAs or the spacing between them to gauge the strength of a trend. The strategy can be adapted and combined with other indicators or forms of technical analysis to enhance its effectiveness and manage risk.